direct deposit owner's draw quickbooks

Update any owner information if needed. Enter the total amount in the Amount column.

Guarantee the Zip code has only 5 digits.

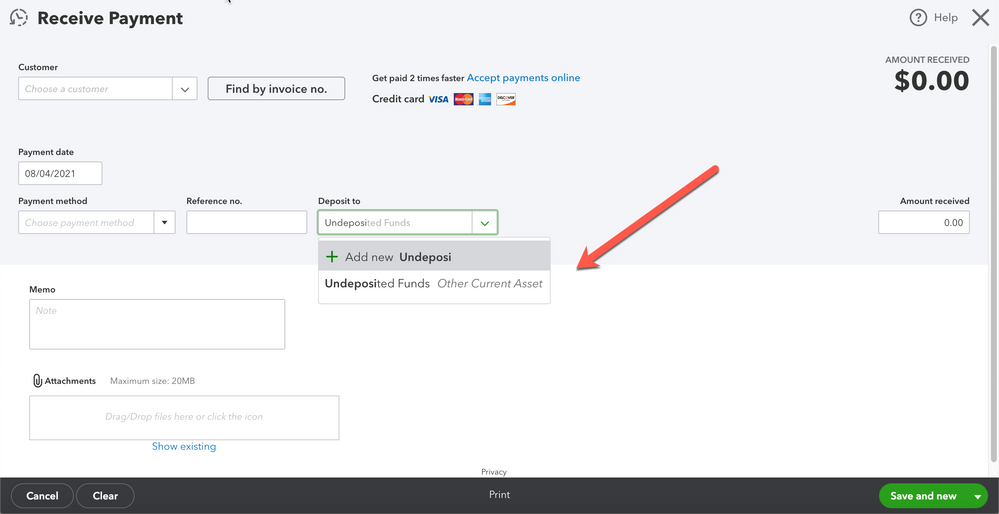

. If you receive customer payments directly deposited into your company bank account then you must set up QuickBooks to receive and record payments in a way t. And an expense item for Banking Fees or Service Charges with the item coded to an account called Banking Fees or Service Charges. Choose Lists Chart of Accounts or press CTRL A on your keyboard.

You can either set up your direct deposit while setting up payroll or by going to EmployeePayroll InfoDirect Deposit. Click Save Close. At the bottom left choose Account New.

In the given Balance field add the particular amount of the owners contribution. In the Verify Your Company Information zone. To guide you further you can follow these steps.

Smith Draws Post checks to. From the Industry drop-down pick the. Start paying employees using Direct Deposit.

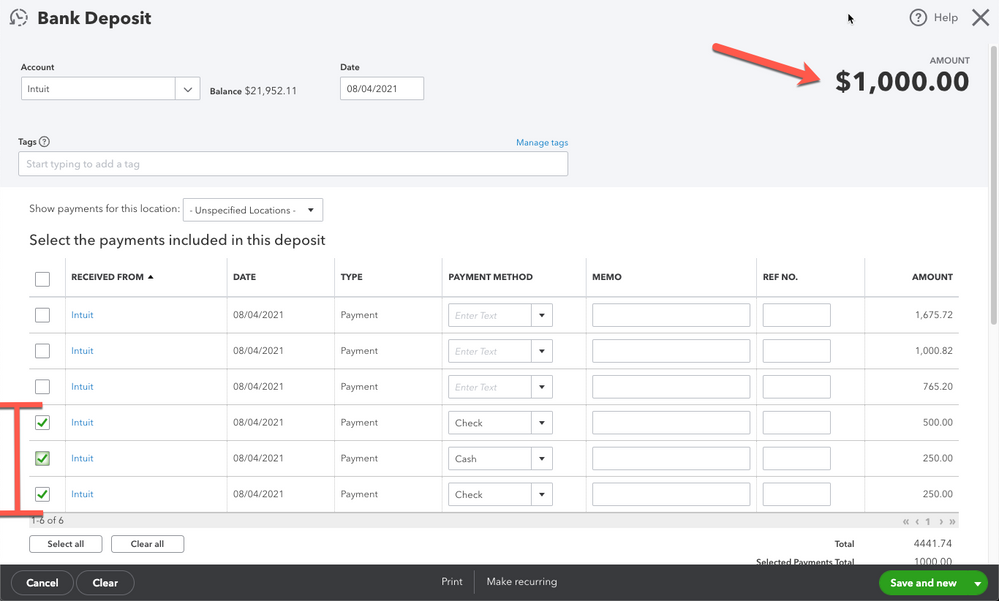

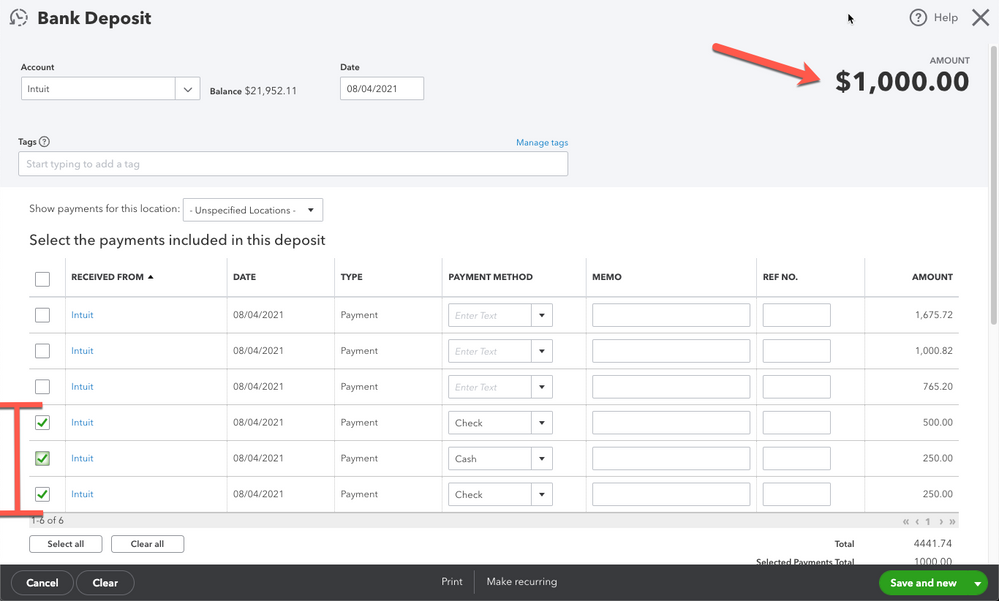

Firstly Open the quickbooks and then open the company file. These fields are Bank Account number ABARouting number and the Checking or Savings field. Click on icon Select Bank Deposit.

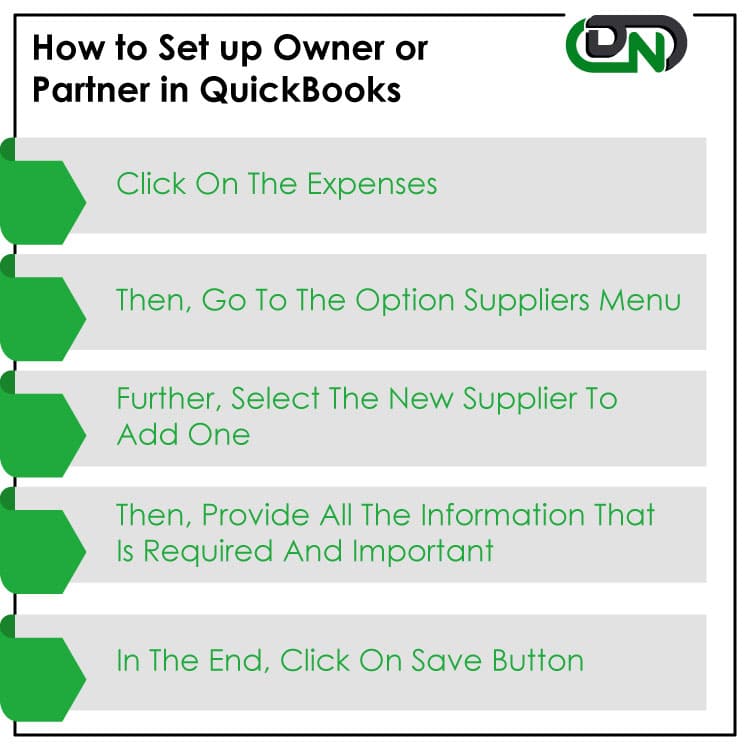

Write a Check to Fund Petty Cash or a Cash Drawer. Enter the employees financial institution information and then click OK to save the information. When making a direct deposit payment to an owner youll need to set up an owner or partner as a vendor as suggested by my colleagues above.

If you have been wondering about paying your 1099 Contractors with Direct Deposit now you can if you are a QBO Payroll or QBO Full-service Payroll user. To open an owners draw account follow the following steps. Withing QBO you will find the Workers tab where you can find company vendors that.

Choose Lists Chart of Accounts or press CTRL A on your keyboard. Go to the Expenses menu. Below are the steps to Record Owner investment in quickbooks.

Setup a sales item for Gift Certificate Sales with the item coded to a revenue account. Set up and Process an Owners Draw Account. The effect of recording an advance payment correctly in QuickBooks is that the deposit is added to a current liability account the credit and to a cash account the debit on the balance sheet.

From here choose Make Deposits and then select the bank account where youd like to deposit your personal investment. You can select the Equity option. After opening the company file go for the Banking menu and then click the Make Deposits option.

Within the Vendors tab select New Vendor. To set up your company for direct deposit in QuickBooks verify your companys information including the legal name address EIN and industry. Click Save Close References.

An owners draw can help you pay yourself without committing to a traditional 40-hours-a-week paycheck or yearly salary. If you have been wondering about paying your 1099 Contractors with Direct Deposit now you can if you are a QBO Payroll or QBO Full-service Payroll user. Complete and review the structure.

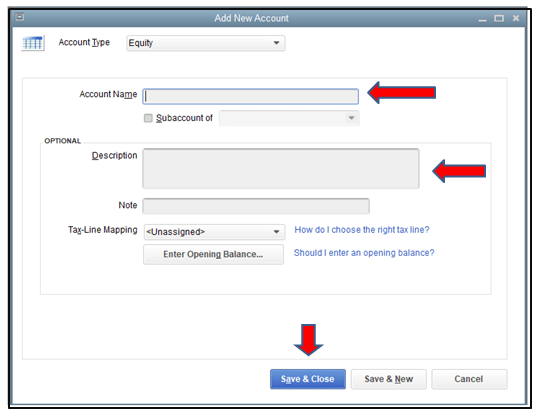

Now select the line included payment you want to delete and click on the Edit menu to select the Delete Line. In QuickBooks Desktop software Select Lists menu option Further click on the Chart of Accounts from the menu or Press the CTRL A on your keyboard. Enter the account name Owners Draw is recommended and description.

You have an owner you want to pay in QuickBooks Desktop. If you see a sign -up page instead of the Direct Deposit window you need to go back to the previous steps to sign up for direct deposit and validate your bank account. Create the paychecks in QuickBooks.

Click Equity Continue. Go to the Employees menu select My Payroll Services by then Activate Direct Deposit. If you dont see your preferred bank account listed youll need to add it.

You can either set up your direct deposit while setting up payroll or by going to EmployeePayroll InfoDirect Deposit. Navigate to the Name field and press on the Owners Contribution. Direct Deposit with QuickBooks Integration During the initial Integration set up three fields are automatically created in each employees profile.

Do whatever it takes not to consolidate the growth. To record an owner contribution in Quickbooks launch the Quickbooks program and click the Banking tab at the top of the home screen. Once this is Done press on the Detail Type drop-down menu and select the option that says Owner Equity.

If I were recording this direct deposit entry in QuickBooks I would follow these steps. From the Accounts Drop Down menu select the bank account in which you want to add the Owner investment. Check the Use Direct Deposit for box and supply the employees bank account information.

Select the business account used to fund the purchase. Details To create an owners draw account. To record an owner contribution in Quickbooks launch the Quickbooks program and click the Banking tab at the top of the home screen.

To record an owner contribution in Quickbooks launch the Quickbooks program and click the Banking tab at the top of the home screen. To write a check from an owners. Fill out the form.

Select Use Direct Deposit for checkbox and then select whether to deposit the paycheck into one or two accounts. Instead you make a withdrawal from your owners equity. Register For Direct Deposit.

QBO - Pay Contractors with Direct Deposit. Enter the account name Owners Draw is recommended and description. Note that customer deposits show up on the balance sheet in QuickBooks this way regardless of whether the balance sheet is accrual or cash basis.

You will need to decide which Account or Accounts you wish your payment to be deposited to then report the information defining the target Account s. To save the changes click on the Save option. Set up draw accounts.

Open the chart of accounts and choose Add Add a new Equity account and title it Owners Draws If there is more than one owner make separate draw accounts for each owner and name them by owner eg. Once done select Save. Click the Payroll Info tab and then click Direct Deposit.

Direct Deposit in the Employee Information section. Now add funds in the deposit section and the name of the investor in the received form field. Select the Expenses tab and click the Account drop-down list.

You have to select the Account Then click on the New option from the menu on the bottom left Continue by clicking Equity. The Intuit Quickbooks payroll direct deposit form is a legal document that allows an employer to provide payments to its employees via direct deposit. New things are always rolling out for QuickBooks Online to make work easier.

Afterward set up an equity account. Enter Money Deposite Date.

Connect And Review Your Banking In Quickbooks Onli

Setup And Pay Owner S Draw In Quickbooks Online Desktop

How Can I Pay Owner Distributions Electronically

Understanding Quickbooks Lists Chart Of Accounts Informit

How Do I Pay Myself Owner Draw Using Direct Deposi

How To Record Owner Investment In Quickbooks Set Up Equity Account

Quickbooks Training Purchase Order For Inventory And Receive Inventory Quickbooks Quickbooks Training Consulting Business

How To Record Owner Investment In Quickbooks Set Up Equity Account

How To Run Payroll Set Up Direct Deposit In Quickbooks Online Youtube

How To Create Employee Profiles In Quickbooks Desktop Youtube

How To Pay Expenses W Owner Funds In Quickbooks Online Youtube

How Can I Pay Owner Distributions Electronically

Tutorial Pay A Contractor With Direct Deposit Quickbooks Online Youtube

Using Undeposited Funds In Quickbooks Online

.png)

Quickbooks Online Tag Tricks You Need To Know Berrydunn

Using Undeposited Funds In Quickbooks Online

Quickbooks Training Purchase Order For Inventory And Receive Inventory Quickbooks Quickbooks Training Consulting Business